Ali Alnattar is a banking operations expert with over 11 years of experience, specializing in compliance, client onboarding, and sanctions screening. His professional focus centers on maintaining a continuous self-learning journey, with a strong emphasis on using artificial intelligence as a practical tool to improve efficiency across financial services and related sectors.

AI is not viewed as a single solution, but rather one tool among many that, when applied correctly, can significantly reduce operational friction—particularly in compliance-heavy environments like banking.

😥 The Challenge: Manual Compliance and KYC Processes

During client onboarding—whether for individuals or corporate entities—banking employees often spend excessive time:

Searching across multiple sanctions authorities

Collecting fragmented client data

Verifying information manually

Repeating checks across disconnected platforms

These processes increase operational cost, slow onboarding timelines, and elevate compliance risk.

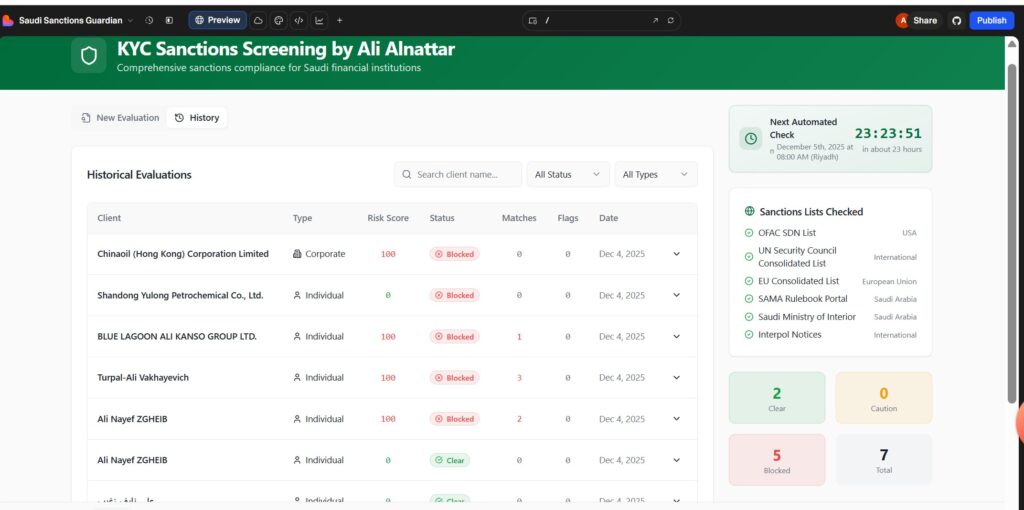

😄The Solution: AI-Driven Sanctions Screening and KYC Automation

To address these challenges, an AI-powered algorithm was developed to simplify sanctions screening and KYC workflows. The system is designed to:

Aggregate data from multiple sanctions authorities

Sort and extract only the required compliance data

Integrate results through APIs into a single, unified view

This approach significantly reduces time and cost during the onboarding process while improving accuracy and consistency.

✅ Supporting Shadow Vessel Tracking

Beyond client onboarding, the solution also supports shadow vessel tracking, enabling trade and banking teams to quickly assess whether a vessel is operating outside regulatory frameworks. What traditionally required lengthy manual research can now be completed with far less effort and faster turnaround.

⚙️ AI Tools and System Architecture

Together, these tools form a system capable of pulling the required compliance data efficiently and presenting it in a usable format for banking professionals.

💪🏻 Overcoming Integration Challenges

While the concept appeared straightforward, technical challenges emerged during implementation—particularly related to JSON data handling, which the UI layer initially struggled to process. Debugging required extensive investigation, as tool-level error feedback was limited.

After several hours of analysis, the issue was resolved, allowing seamless data flow between system components. This highlighted a key reality of AI-driven systems: integration and orchestration are as critical as the models themselves.

🔧 Impact on Banking and Compliance Teams

The solution directly benefits:

Banking service employees

Compliance and onboarding teams

Trade finance and risk teams

Key outcomes include:

Faster client onboarding

Reduced manual research

Improved sanctions screening accuracy

More efficient shadow vessel detection

💼 Career Journey: From Banking Operations Expert to AI Compliance Innovator

| 🏢 Role | 💡 الخبرة | 🏆 Key Contributions |

|---|---|---|

| Banking Operations & AI Compliance Specialist | Over 11 years of progressive experience in banking operations, corporate and SME credit management, and client onboarding. Skilled in corporate loans, trade finance, risk assessment, and process optimization, with a strong focus on leveraging AI for compliance automation and operational efficiency. | Streamlined banking operations and credit processes, implemented AI-driven solutions for KYC and sanctions screening, optimized compliance workflows, reduced operational errors, and led teams to improve efficiency and performance. |

Certifications & Education

- Diploma, Banking and Financial Support Services

- Elements of AI for Business – University of Helsinki

- Digital Product Management: Modern Fundamentals – Coursera

- Diploma in Banking – Institute of Public Administration (IPA)

📈 Professional Impact

Ali Alnattar’s career includes impactful contributions across leading banking institutions, demonstrating efficiency, compliance, and innovation:

Lendo – Streamlined SME credit operations, improving loan processing efficiency and portfolio performance.

First Abu Dhabi Bank (FAB) – Enhanced corporate banking operations through process improvements, automation, and risk mitigation strategies.

Alawwal Bank – Led operational teams, optimizing banking workflows and improving service delivery.

Arab National Bank – Delivered high-quality customer service and ensured regulatory compliance in client-facing operations.

This combination of deep banking expertise and AI-driven innovation positions Ali Alnattar as a key figure in compliance automation, client onboarding, and operational excellence within the banking sector.

💡 Why Companies Should Take Notice

Ali Alnattar isn’t just a banking operations expert — he’s a builder of AI-driven compliance and onboarding excellence.

By combining over a decade of hands-on experience with advanced AI tools, he represents the next generation of banking professionals who:

✅ Streamline Compliance: Automate KYC and sanctions screening to reduce onboarding time and operational costs.

✅ Boost Operational Efficiency: Enable banking and trade teams to focus on high-value tasks instead of repetitive manual checks.

✅ Ensure Accuracy and Reliability: Deliver consistent, compliant results across multiple regulatory authorities.

✅ Integrate Multi-Tool AI Solutions: Orchestrate multiple AI platforms into a single, scalable system for practical, real-world application.

For organizations looking to modernize client onboarding, strengthen compliance, or implement AI in financial operations, Ali Alnattar provides a proven model for responsible and effective innovation.

🌐 Discover More

Ready to connect with top-tier IT and AI talent?

🔗 Explore Ali Alnattar’s full portfolio on Ka.nz

and discover how AI-driven solutions can transform client onboarding, KYC, and sanctions screening for your organization.

I am Aya Al Dorzi, a passionate community manager and project management graduate with a strong interest in marketing, digital strategy, and online business growth. I earned my bachelor’s degree in Operations Project Management and have since developed hands-on experience in content creation, community building, and digital marketing.

I currently work as a part-time blogger at Kanz.com, where I create engaging and informative content that connects with diverse audiences. Alongside this, I manage my own YouTube automation and e-commerce brand, focusing on developing creative strategies that drive growth and brand identity. I’m dedicated to continuous learning and aspire to expand my expertise in management, leadership, and digital entrepreneurship.